Writing and sending a regular Investor Update is one of the most powerful things you can do for your startup. But did you know there are actually two types of Investor Updates?

The first is for startups that have already raised money, and the goal here is to keep your investors in the loop, actively helping out.

The second is for investors who might fund you in the future, and the goal here is to build relationships and to "pre-market" your deal.

Read on!

Have you raised money?

If so, you should be sending your investors a regular Investor Update.

First, it’s very likely you’ll ask them to invest in future rounds, or tap them for introductions to later-stage investors. They need to know what's going on.

Second, NOT sending regular updates is a HUGE negative signal. As super angel investor Jason Calacanis puts so eloquently: “If your startup isn’t sending you regular updates, it’s going out of business.”

Common sections are: Company Overview / Key Wins & Highlights / KPIs and Metrics / Product News / Press & PR / Key Hires & Needs / Challenges / Runway / How You Can Help / Looking Ahead

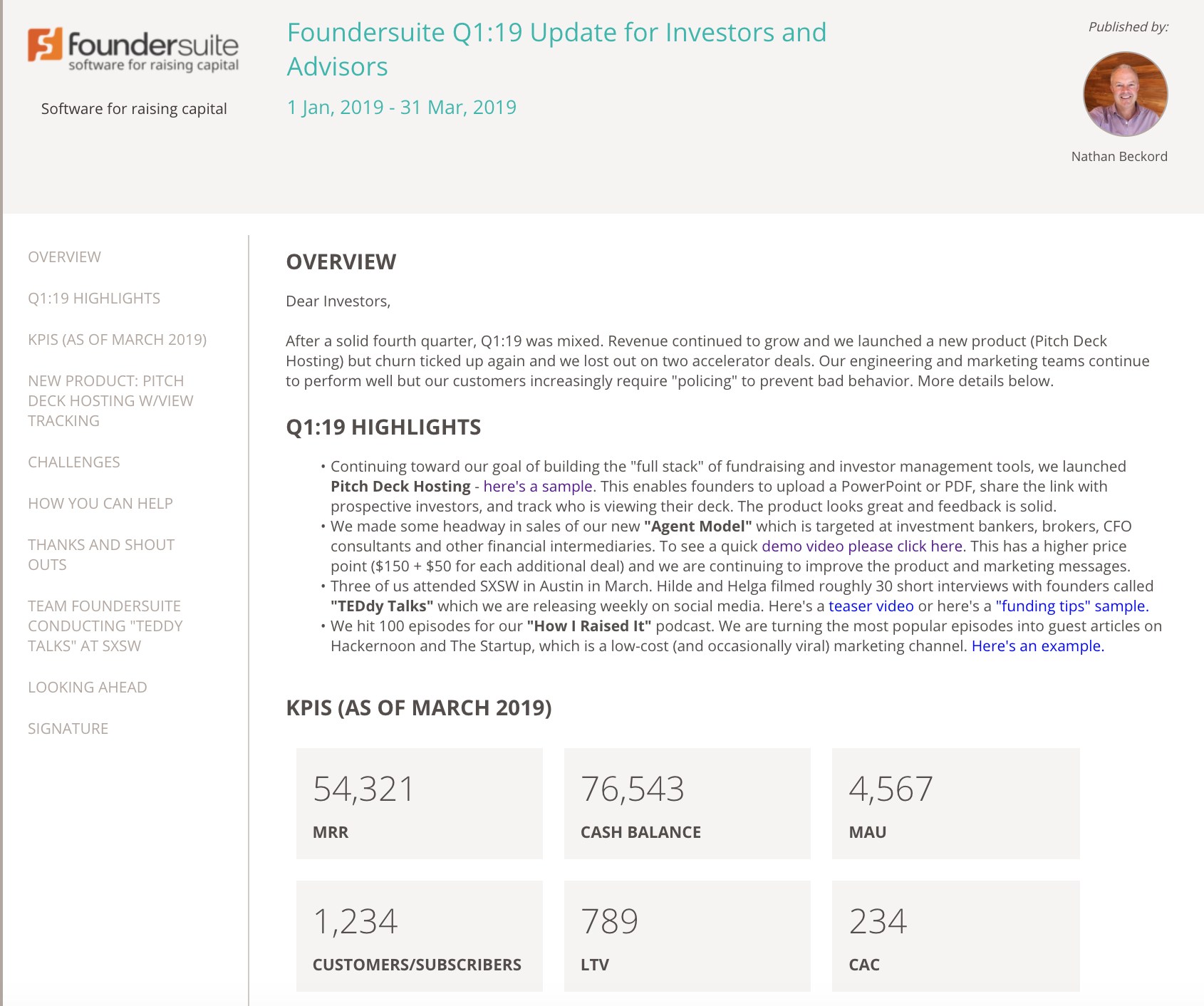

Click here for an example of an Update for your existing investors. (Go ahead and click :)

Are you raising money? Or planning to?

If so you should be sending prospective investors a regular Company Update.

The goal here is a different — the Update is a “marketing tool” that helps you build relationships and a track record BEFORE you ask for money.

As VC Mark Suster puts it, “VCs invest in lines, not dots” — meaning they need to get to know you before writing a check. Think of this type of Update as "drip marketing" and / or a "nurture campaign."

Common sections are: Company Overview / Key Wins and Highlights / Metrics / Product Update / Looking Ahead / Team Photo.

This type of update is typically shorter, and overwhelmingly focused on the positive things going on with your company, not challenges or problems.

Bonus points if you repeatedly create a "virtuous cycle" by telling investors what you plan to do ("Looking Ahead"), executing on those plans, and reporting back the next month ("Key Wins").

Investors *love* to back founders who demonstrate they can plan, execute, and communicate.

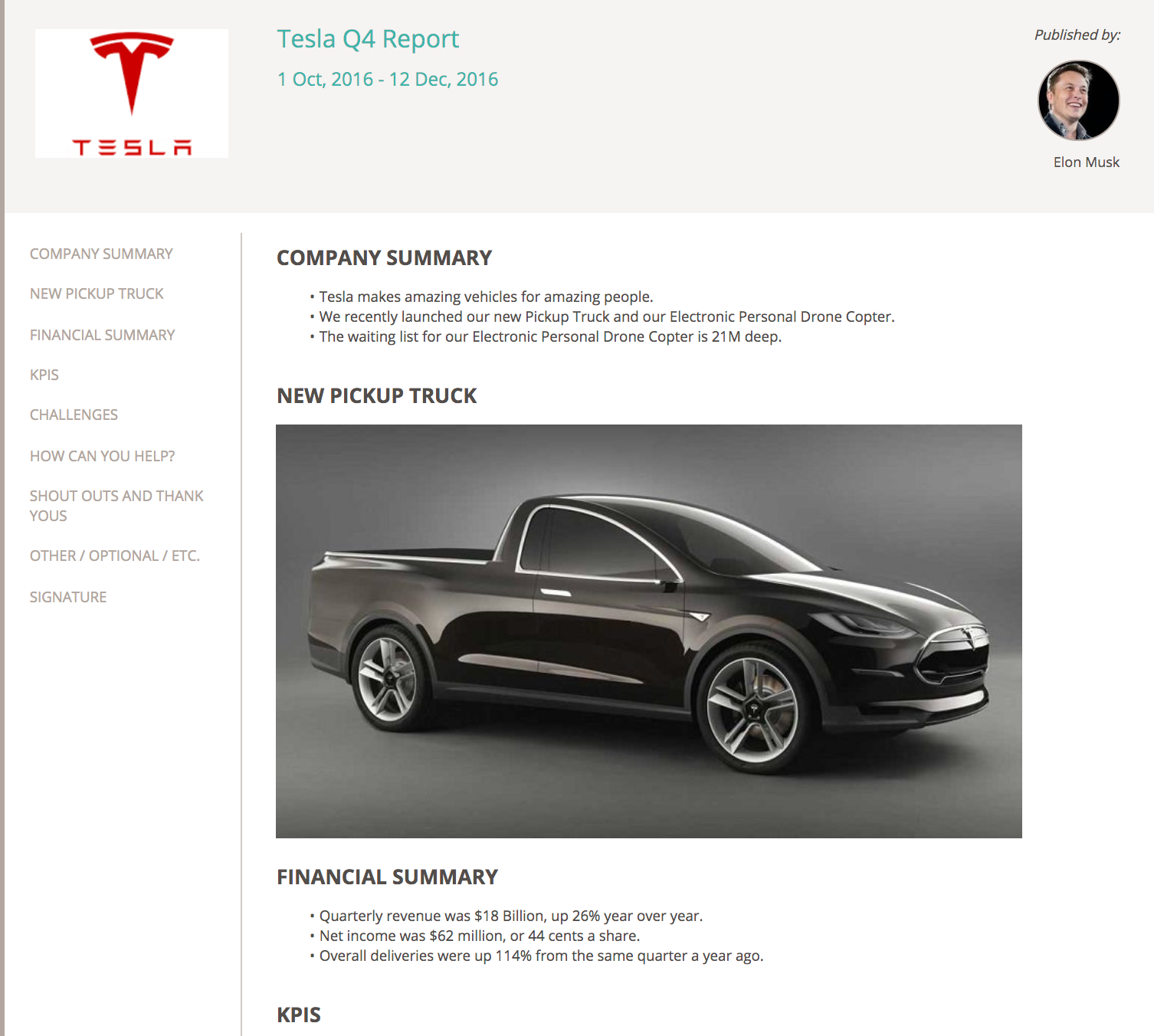

Click here for an example of an Update aimed at prospective investors.

Hacks for building your email distribution list

An expert level "funding hack" is to build a list of 100 or even 200 well-researched and well-qualified investors, and then reach out 6 to 12 months BEFORE you plan to raise capital, and ask if you can add them to your Update distribution list.

Reach out to each investor with a personal, one-to-one email (it's ok if it's cold) and ask to add them to your list. Here is some text to use:

Subject: <Company name> Updates to <Investor or Fund Name>

Hello <investor name>

I am a founder of <insert company name>. We make <super short description of what you do> and have <most impressive achievement, or most exciting metric / data point>.

We are not raising money right now, but plan to later this year.

We send out a short, 1-page Company Update detailing our progress and key highlights.

I would love to give you a early look at what we are building here at <Company name>.

May I have your permission to add you to our distribution list?

Best,

[Your name]

Most investors will say "yes" because a) there's no real risk to do so and b) it's their job to identify promising startups before other VCs so you're playing to their natural FOMO.

Next, send this monthly Update with your company’s progress to everyone who has "opted in." Block the time off on your calendar as a recurring event to make sure it gets done. Do it religiously, and by the time you’re ready to ask for money, these investor leads will be red hot.

I have literally seen startups raise capital in under 2 months – but it is 99% because they had "warmed up" their investor list for several months prior to flipping the fundraising switch.

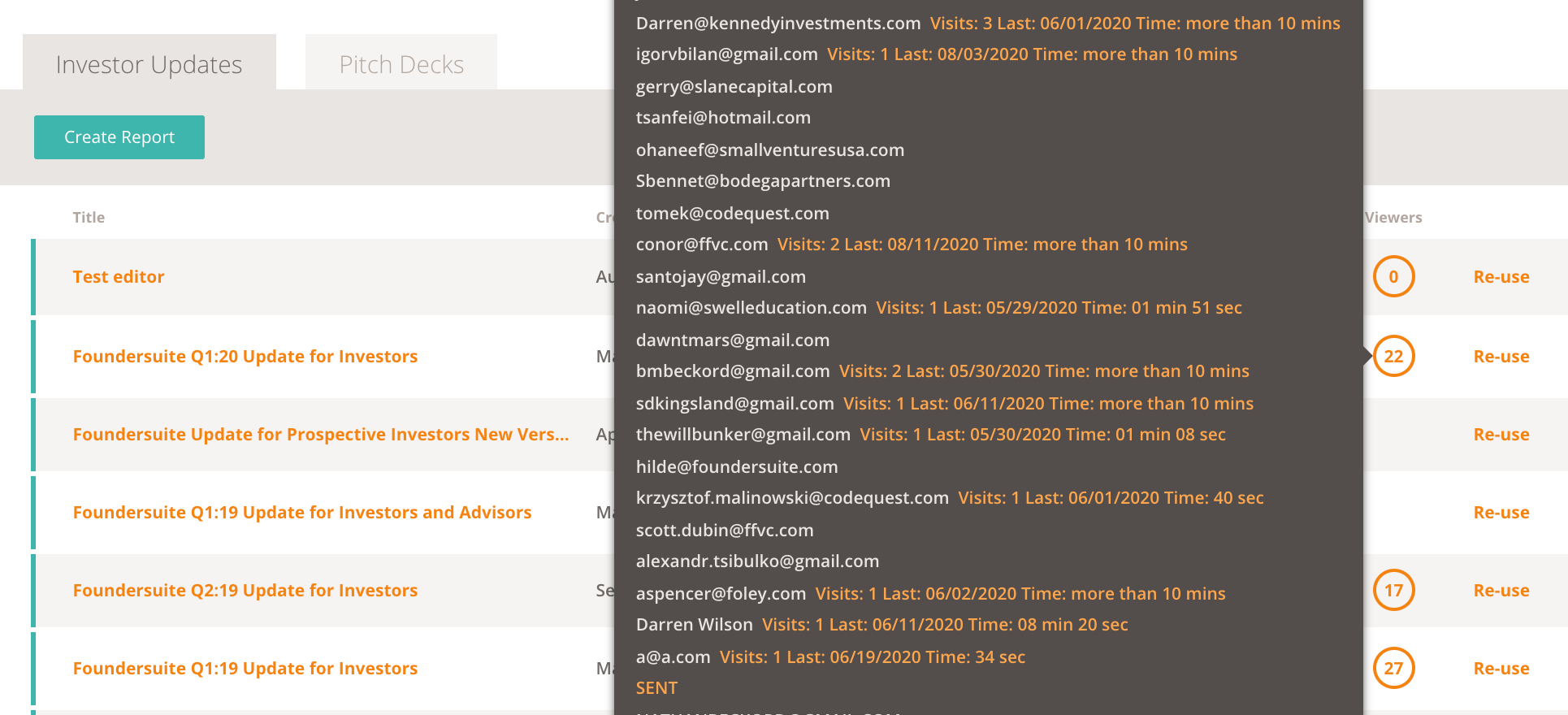

Tracking views and engagement

After sending out your monthly Investor Update, keep track of who's viewing it, and how much time they spend. This is a good signal of investor interest.

For example, if you send it to 200 investors, and 100 of them open it, and 25 of those spent 5+ minutes... this is your "engaged" audience, the ones who are tracking your progress.

They are also most likely to write you a check.

Carpe Diem

Sending regular Investor Updates is one of the highest-ROI activities you can do to grow your startup.

Start today – crank your first one out in 30 minutes or less – and block off a monthly recurring time slot on your calendar NOW to keep on track.

Go get 'em, tiger!