Multimillion-dollar deals and promising new partnerships often grab the headlines in the startup world, but when you’re raising capital for your own company, there’s a lot of behind-the-scenes work that never gets talked about.

It’s one of the reasons why I started the How I Raised It podcast — so I could share stories from founders about what it actually takes to get funded.

After 200+ podcast episodes and more than 20 years of helping founders raise capital, I can tell you that successful fundraising is directly related to how quickly you can move and how excited you can get investors about your company.

But setting up a streamlined fundraising round requires a lot of unsexy preparation to be ready to go, right out of the gate — and avoid the common pitfalls of cold email pitches, lapses in follow-up, and bad pitch decks that hamper so many first-time founders.

After you have researched and qualified a list of 150+ investors to fill your fundraising funnel but before you hit send on your first email, take a moment to do these three important things:

1. Map the best path to warm introductions

When it comes to reaching out to potential investors, cold emails are always an option — just not a good one.

Investors receive hundreds of pitches a day, many of them warm pitches from folks who have done their homework to find a mutual connection. In a crowded inbox, your cold pitch already has a mark against it because you didn’t put in the effort to network your way in.

In fact, a partner at Uncork Capital, a popular Bay Area seed-stage VC, said that of the 700 startups they funded in the past decade, only two came from cold pitches.

LinkedIn is a great tool to search for network connections, but what if you don’t find any contacts in common?

In the absence of a mutual contact, look for founders that your target investor has invested in within the past 6-12 months. Cold email that founder and ask for 15 minutes of their time to find out what it’s like to work with the investor. Once you get a dialogue going with the founder, it’s perfectly acceptable to ask for an introduction.

If you find more than one possible pathway to an introduction, prioritize who you will ask first. Here’s a helpful hierarchy that ranks potential connectors from the most powerful to the least:

- Someone who has made your target investor money in the past, through growing or selling a profitable company

- Someone who has done deals with your target investor in the past

- Someone who has fed your target investor leads on good deals

- Someone your target investor has invested in (as mentioned above)

- Someone who is connected with your target investor on LinkedIn

2. Organize your investor pipeline

Now that you have your list of qualified target investors and you know how you are going to reach them, it’s time to get organized.

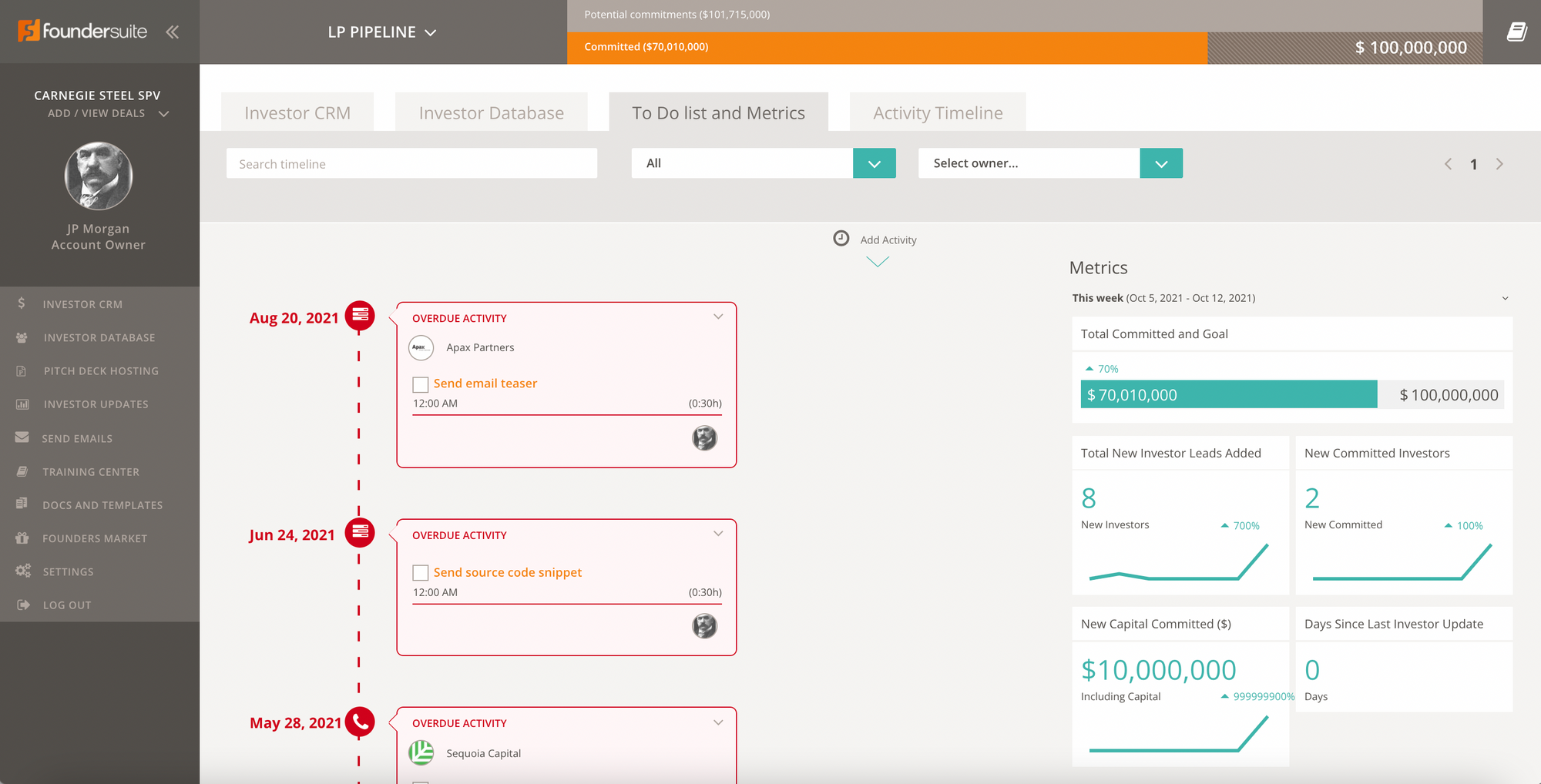

Pitching investors is a numbers game, and one important number to be aware of is the number of follow-up tasks and actions that you’ll need to check off during this process. If each conversation, email, or pitch with an investor leads to 2-3 next steps, then talking to 200+ investors could leave you with a to-do list of 600+ follow-ups! You must have a way to keep track of this process you’re juggling, or you’re going to drop a ball.

Whether you choose to use a spreadsheet or a dedicated Investor CRM like Foundersuite, find a way to track where each target investor is in the process. Have you emailed them? If so, have they responded? Have they looked at your pitch deck? Where are you in due diligence? What are next steps?

Your job as founder and/or CEO is to move each investor from one stage of this process to the next. If an investor has replied to your email, what can you do to get a pitch meeting on the calendar? How can you nudge the VC you just pitched toward talking about terms?

Find a system that will help you stay on top of every conversation you’re having because leaving too much time between points of contact will turn the deal stale — and investors can smell a stale deal from a mile away!

Block off a few hours or even a couple of days each week to focus solely on fundraising, and be sure to keep notes, follow-up tasks, email threads, and even potential commitment amounts right at your fingertips. Your fundraising round won’t last forever, but while it’s happening it needs to be your primary focus.

3. Hone your pitch, deck, and model

The number one reason founders fail? From what I’ve seen, their pitch is crap.

You don't get a do-over; you can’t go back to an investor two months later and say, Oh, we’ve improved our deck. Can I pitch you again? You get one shot, so you need to go out with an amazing pitch deck.

After you’ve selected a solid framework for your deck, take it to the next level with these tips:

- Include a financial model that helps investors envision where you’re going next. If you’re raising $1 million, show them how you’re going to spend it and where it will take the company. Show what the business model looks like at scale.

- Add a one-page executive summary about your business (some investors will ask for this). Similar to a deck, this should cover Problem, Solution, Market, Traction and Team and fit on one page.

- Make your deck look good. If your company is seeing awesome traction, investors may be able to overlook a messy deck. But at the end of the day, everyone you’re pitching is a human being who is likely to interpret a sloppy deck as a sign that you run a sloppy business.

Once you feel like your deck is in good shape, send it to 5-10 people you know will give you honest, hard feedback about your deck. Sign up for a pitch deck tune-up or review from someone who has seen thousands of decks. (Foundersuite gold subscriptions include a 30-minute review!)

Lastly, it never hurts to have a few practice pitches — line up some of your third-tier investors as your first meetings and use their feedback to make improvements before you reach out to your dream investors.

Nathan Beckord is the CEO of Foundersuite.com which makes software for raising capital. Foundersuite has helped entrepreneurs raise over $3 billion in seed and venture capital since 2016. He also hosts the popular How I Raised It podcast, a behind-the-scenes look at how startup founders raise money. This article is the second in a series about fundraising hacks.