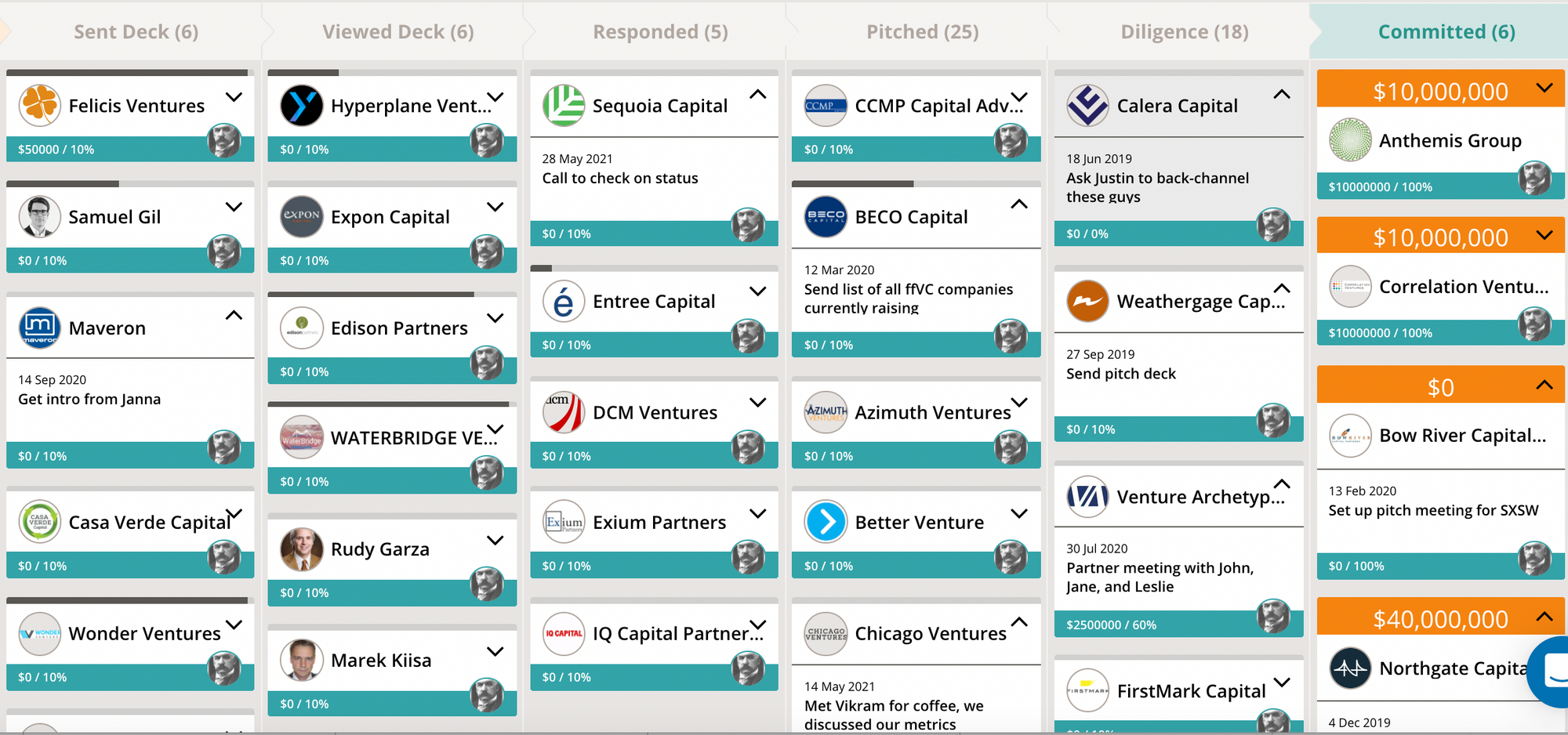

Over the course of my 20-year career in raising capital for startups, I’ve come to see fundraising as a focused sales process, one that begins by filling your pipeline with qualified investors and ends with you closing a deal for your company.

I’ve helped thousands of founders learn how to streamline this crucial process by breaking it down into easy-to-master steps, and it all starts by building — and qualifying — your investor list.

The step-by-step process for building a list of relevant target investors

First things first: building an investor pipeline is a numbers game.

When I raised our seed round for Foundersuite, I pitched more than 200 investors and ended up with checks from one VC and 10 angel investors.

If you do the math, you'll see that's a 5% conversion rate — which means I was rejected 95% of the time. As dour as that sounds, this is pretty typical across the industry, emphasizing how important it is to build a healthy top-of-funnel list. So how the heck do you do that?

Here are eight places to find investors for your startup, and some tips for qualifying these prospects.

Investor databases & online resources

1. Foundersuite: Our database of more than 208,000 investors is searchable by keyword, investor type, industry, and location. It includes 146,000 angels and HNW investors, 13,000 VCs, 7,000 PE firms, 8,000 LPs, 1,200 strategics / CVC, 1,000 family offices, and 300 fund-of-funds. It's a great place to start the "hunt" for relevant investor targets.

2. Crunchbase: This is another searchable database of investors. A handy way to use this platform is to look up 10-12 companies that are similar to yours but not direct competitors. Look to see who invested in them at your stage, and add those names to your list. Crunchbase will also show you who investors like to co-invest with, which can expand your funnel.

3. Subscribe to fundraising newsletters: Newsletters such as PEHub, Inside Venture Capital, Venture Pulse, and Strictly VC offer regular updates on new fund announcements, which companies are getting funded, and who is funding them.

TIP: The best venture fund to be pitching is one that just raised a new fund. Follow new fund announcements to get in during the first year or two.

4. Conference speaker lists: Investors love to build their own brands by speaking at conferences and events. Take a look at the agendas of startup and VC events and seek out speakers who are in your industry.

5. Quora, TechCrunch, Medium: There are some great investor lists out there on these and other online platforms. Look for “top investors” lists in your sector or location.

6. Twitter: More and more investors and founders are active on Twitter, and there are plenty of insights to be gleaned just by following some of your favorite VCs.

Mining your personal network

Finding investors who are already connected to your personal network is a great way to turn cold leads into warm ones.

7. LinkedIn: Make use of LinkedIn’s search function to comb through thousands of potential connections.

- Begin by typing in a general query like “angel investor,” which will generate 100,000+ results.

- Narrow it down by applying filters — start with 2nd-degree connections, add some geographic and industry filters.

- As you scroll down the list, open any profiles that look interesting in a separate tab (right-click or Command+click to do this quickly).

- Once you have 50-100 tabs open, spend 20-30 seconds skimming each person's profile. If the person looks like a fit, add the investor to your list and make note of your top mutual connection.

TIP: Know your keywords to make this process go faster. When I’m building a list for Foundersuite, I’m skimming for words like fintech, SaaS, and SMB.

8. Advisors: If you have advisors you’re leaning on to help you with fundraising introductions, invite them to take a look at your pipeline, add any investors they would be willing to introduce you to, and skim over your research list for any insights or mutual connections. Repeat this with 4-5 advisors, and you could end up with 50-60 warm introductions.

Qualifying your list

Once you've tapped the 8 sources listed above, you should have a really healthy top of funnel, ideally 200-400 names. But the work does not done here – the next step is to hone that list down to the most qualified individuals.

Why? Because fundraising is a sales process, and top performing salespeople look for leads who are most likely to buy. They filter, prioritize, and focus their energies on the best candidates – the "best fit" folks. We can apply this same skill to fundraising.

Dig into each of your targets – meaning, click through to their websites, study their LinkedIn profiles, follow them on twitter, and remove any who fit these criteria:

- They’ve invested in a direct competitor. An ethical investor will refuse a meeting; an unethical one will send your pitch deck to your competitor.

- A venture fund that hasn’t raised a new fund in 2-3 years. A group like this is likely focused on follow-on deals. It may be worth setting up a meeting to practice your pitch, but don’t waste too much time pitching funds that aren’t doing new deals.

- An angel investor who hasn’t done a deal in 5+ years. Check their portfolio on AngelList or LinkedIn. If it’s been a while, they’re likely taking a break from new deals.

- The investor is in the wrong sector or stage. Learn to interpret the clues. For example, a “growth capital” company works with startups in later stages and won’t be interested in your seed round pitch.

- The investor is in (or invested in) the wrong geographic location. This matters much less than it used to, but it’s worth a quick check.

- They have a bad reputation. You’ll be married to this investor for the next 5-8 years of your life, so talk to other founders and lean on any group insights available to you through an incubator, accelerator, or network.

- TIP: The vetting shouldn’t stop here. Make time in your due diligence period to do some back-channel research on your investors to make sure they’re good for you and your company.

Use these filters to cross 25-30% of the names off of your list, leaving you with only well-qualified investors to pursue, saving you time, energy, and at least a few dozen rejections along the way.

Following this process will make your fundraising go exponentially faster.

Nathan Beckord is the CEO of Foundersuite.com which makes software for raising capital. Foundersuite has helped entrepreneurs raise over $3 billion in seed and venture capital since 2016. He also hosts the podcast How I Raised It, a behind-the-scenes look at how startup founders raise money. This article is the first in a series about fundraising hacks.