Fundraising isn’t roulette; it’s a structured sales process. Most founders spray cold emails, chase random intros, and pray. Nathan Beckord, foundersuite’s CEO and a two-time founder himself, swears by the pipeline mindset: fill the funnel, qualify hard, lean on warm intros (~30× more effective than cold), and keep momentum roaring until the wire hits.

Treat Fundraising Like a Sales Process

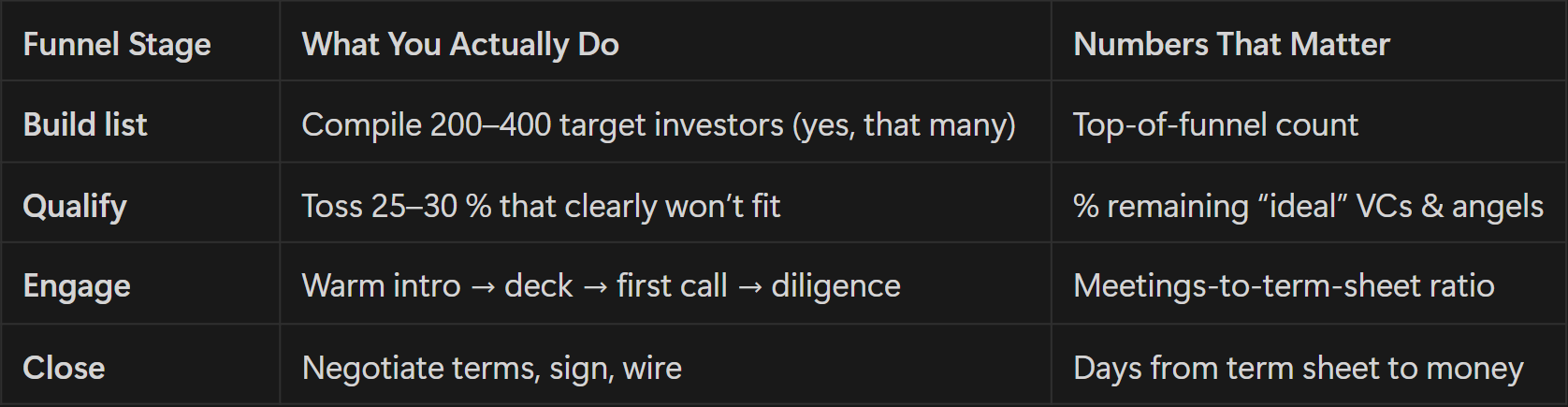

Fundraising has four distinct stages: build list → qualify → engage → close. Just think of it as selling startup equity instead of software.

Honestly, cold emails rarely get the job done. Most VCs are drowning in pitch decks, and your carefully crafted message might end up collecting dust in their inbox. In fact, fewer than 5% of cold emails even get a response.

But here’s where things shift: warm introductions change the game. When a trusted connection forwards your deck with a simple, “Hey, you should meet this founder,” response rates jump to 20–30%. That’s not a small difference, that’s a massive edge.

And don’t forget, you’re not just looking for someone to write a check. You’re choosing a long-term partner. This person might sit on your board, help you navigate tough calls, and influence the trajectory of your company for the next 5 to 8 years. So it’s not just about getting in the door, it’s about choosing the right door to walk through.

Definitions (just so we’re talking the same language)

- Warm Introduction – A referral email from someone the investor already trusts.

- Sales Funnel – A step-by-step track that moves prospects from discovery to decision.

- Due Diligence – The deep-dive review investors perform before wiring money.

Building Your Investor List the Smart Way

Let’s say you’re raising a $1 million seed round, aiming for $100K checks. Sounds doable, right? But here’s the catch: most founders close only about five percent of the investors they pitch. (DocSend’s research backs this up, showing it typically takes 77 investor conversations to land 40 meetings that lead to a round – and to get 77 investor conversations, you’ll need a much higher number of contacts.)

So what does that mean for you? You shouldn’t just pitch to “whoever will hear you out.” You need a real pipeline; think 200+ qualified investors in your funnel. No shortcuts, no guesswork.

Where to Actually Find These Investors

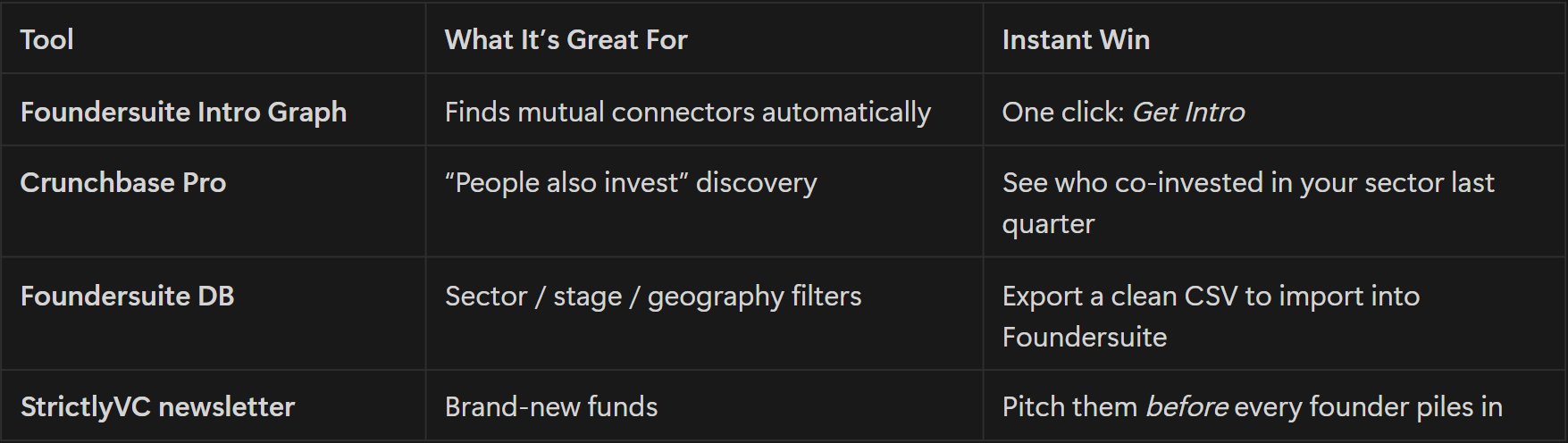

There’s no magic wand, but the right tools will get you 80% of the way there. Here’s where to start:

- Foundersuite Investor Database – Provides access to 210,000+ venture capitalists, angel investors, and firms. Startups can filter by sector, stage, geography, and more to quickly build and export targeted investor lists. The integrated Get Intro tool identifies potential warm introduction paths within your network.

- Crunchbase – Great for reverse-engineering your competitor’s cap table. Look up who invested in companies similar to yours, then go after those firms.

- LinkedIn Sales Navigator – Search for VCs with titles like “partner” or “early-stage investor” and refine by 2nd-degree connections, geography, and sector.

- StrictlyVC and Term Sheet – Subscribe to these newsletters for weekly fund announcements. Pitching new funds early increases your chance of getting through.

The goal here isn’t to build a list of “everyone with a fund.” It’s to create a targeted, qualified pipeline of people who are more likely to say yes, and then structure your outreach accordingly.

Criteria to Filter Investors

Before you hit send, slash the obvious bad fits:

- Industry Fit – Fintech VCs rarely touch biotech, and vice versa.

- Stage Fit – Don’t waste a Series C fund’s time if you’re pre-revenue.

- Geography – Less critical post-Zoom, but time-zones still matter for early board calls.

- Active vs. Dormant – Check the fund’s last deal date; if they haven’t invested in 18 months, move on.

- Reputation – Do your own diligence. Talk to founders they backed and those they passed on.

Tools & Techniques to Source Investors

Digital Tools

Network Hacks

- Advisor Columns in Your CRM – Ask mentors to drop at least ten names into a dedicated column. One health-tech founder scored 50 warm intros in a weekend this way.

- Connector Tags – Inside Foundersuite, tag the best mutual intro for every single investor. No tag? Probably not worth the outreach.

- Reverse-Founder Hack – DM CEOs in a VC’s existing portfolio: “Quick Q: would you still pick Firm X if you could rewind?” Candid feedback plus a potential intro in one chat.

Manage Your Outreach Like a Pro

Use an Investor CRM

Spreadsheets implode after week one: borked formulas, missing follow-ups, version hell. Foundersuite built-in CRM logs every email, calendar invite and Zoom link so you never let a warm lead turn ice-cold.

Mapping Warm Intros

- Plug each target into LinkedIn and see if you have mutual connections (or use the “Get Intro” feature in Foundersuite to do this faster).

- Tag the strongest mutual connection in the Foundersuite CRM.

- Write a forwardable blurb (<120 words, zero jargon): problem, traction, ask, teaser-deck link.

Follow-up Game Plan

- Day 5: Gentle nudge, “just checking if you had a chance to send this along.”

- Day 12: One last ping, then let it go.

No reply? Drop them into your investor-update list and nurture the relationship over time.

Foundersuite’s standout “Get Intro” button turns its 227 000-plus investor database into a warm-introduction engine: it scans your LinkedIn and email contacts, highlights anyone who can vouch for you, auto-drafts a polite ask, and logs the whole thread in your CRM, an approach the company says lifts response rates by roughly 30 % versus cold outreach, shaving weeks off the average raise.

Nail the Pitch and Get Feedback

Your first deck draft? Probably bad. That’s fine. Ship it to ten brutally honest friends. Every question they ask goes into an appendix or becomes a clearer slide title. Nathan Beckord, Foundersuite’s CEO, jokes his decks hit version 52 before investors stopped squinting.

- Open with “Why now?”—market shift, tech unlock, regulatory tailwind.

- Drop metrics early: revenue, usage, retention, and margin.

- Answer “Why you?”—unique insight, unfair advantage, or repeat-founder credibility.

- End every call by asking, “What proof point would turn this from interesting to I need in?” Then zip it. Let them outline the path to “yes.”

Create and Use Monthly Investor Updates

A monthly investor update is a concise summary (usually an email or one-page doc) that founders send to both current and prospective investors. It highlights recent wins and setbacks, key metrics (revenue, burn, runway), product or hiring milestones, and a short “ask” section where founders request introductions or advice.

Why Send Updates Before Fundraising

- Builds familiarity—investors buy from founders they already know.

- Keeps you top-of-mind—in a sea of AI demos and fintech pitches.

- Shows execution cadence—progress every 30 days screams “trust me with your money.”

Founders who send concise monthly updates keep investors warm and are statistically more likely to close new capital quickly. Companies with a steady update cadence are 3 × more likely to raise follow-on funding, and an NFX survey of 870 seed founders found that 60 % communicate monthly – the “Goldilocks zone” for staying top-of-mind.

What to Include in the Update

When it comes to investor updates, short, structured, and consistent wins the game. You're not writing a novel, you’re keeping people warm, informed, and curious.

Here’s what every update should include:

- Quick overview of what you do: Start with a one-liner that reminds people exactly what your startup does. Lead with the core value first, not the technology. Say, “Stripe for AI-powered logistics,” “Helping remote teams onboard in under five minutes,” or “A data-driven fitness coach in your pocket.”

- Key wins last month (customers, hires, product): Highlight the big stuff. Landed a new enterprise customer? Hired a rockstar engineer? Launched that long-awaited feature? This is your time to show momentum.

- Metrics snapshot: Include the basics—MRR, user growth, burn, and runway. You don’t have to share your entire data room, just the top-line figures that show traction.

- What’s coming next: Give a sneak peek into your next 30 days. New hires? Big pilot? Beta release? Let investors see you’re building with purpose.

- Photo of product and team: Yes, seriously. Humans connect with faces and visuals. Drop in a product screenshot, GIF, or a quick team selfie. It brings your story to life.

Send your update once a month, every month. Skip the quarterly cadence or the “whenever I remember” routine. Consistent updates build trust, show discipline, and warm up investors long before you kick off the next round.

Build a Data Room in Advance

What’s a data room? It is a secure folder shared only with investors, similar to a password-protected Google Drive or Dropbox, that contains your financials, cap table, key contracts, product roadmap, and any other diligence documents investors want to review before sending funds.

One of the simplest ways to look like a seasoned founder is to have your data room ready before anyone asks. An organized data room makes due diligence easier and tells investors you’re prepared, professional, and serious.

You can spin one up quickly using Foundersuite’s Data Room, which is tailor-made for startup fundraising.

Benefits of a Pre-Prepped Room

- Rockstar factor – When a VC says, “Can you send over your docs?” and you share a clean, organized data room that same day—you instantly stand out.

- Faster close – Speed matters. A solid data room compresses due diligence from months to weeks.

- Serious-buyer filter – You only hand out access to those who’ve shown real intent, which helps weed out tire-kickers.

So what should you include? Here’s a standard folder structure to get you started:

- Corporate Docs

- Cap Table

- Financials

- Product Roadmap

- Intellectual Property

- Market Research

- Team Bios

- Press Coverage

Pro tip from Nathan: Announce a window like “Data room opens June 1–15,” and watch how quickly casual interest turns into action. It’s a subtle way to create urgency, and filter for the investors who are truly leaning in.

Creating Momentum and Closing the Round

Fundraising momentum isn’t luck; it’s something you build with intention. When things start moving, they move fast. And when they stall? Well, you risk losing investor attention altogether. Here’s how to keep the energy up and the close in sight.

How to Build Momentum

- 48-Hour Intro Blast: Think of it like a product launch. Send out all your warm intro requests within a tight 48-hour window. Why? Because when investors see your name popping up across their network at the same time, it creates urgency, and your calendar fills up fast.

- Weekly traction posts: Share wins publicly. A simple LinkedIn post like “Hit $100K ARR this week 🎉” builds buzz and shows you’re moving. Visibility sparks FOMO, especially when other investors are watching.

- Percentage subscribed: Don’t oversell, but if you're 50%, 60%, or 75% committed, say it. Something as simple as “We’re 65% of the way there” lets potential investors know that space is limited, and they should act now.

- Gate data room access: Don’t make everything available to everyone. Share your data room only with investors who’ve shown real interest. If someone’s dragging their feet? No link. This reinforces that your round is selective and serious.

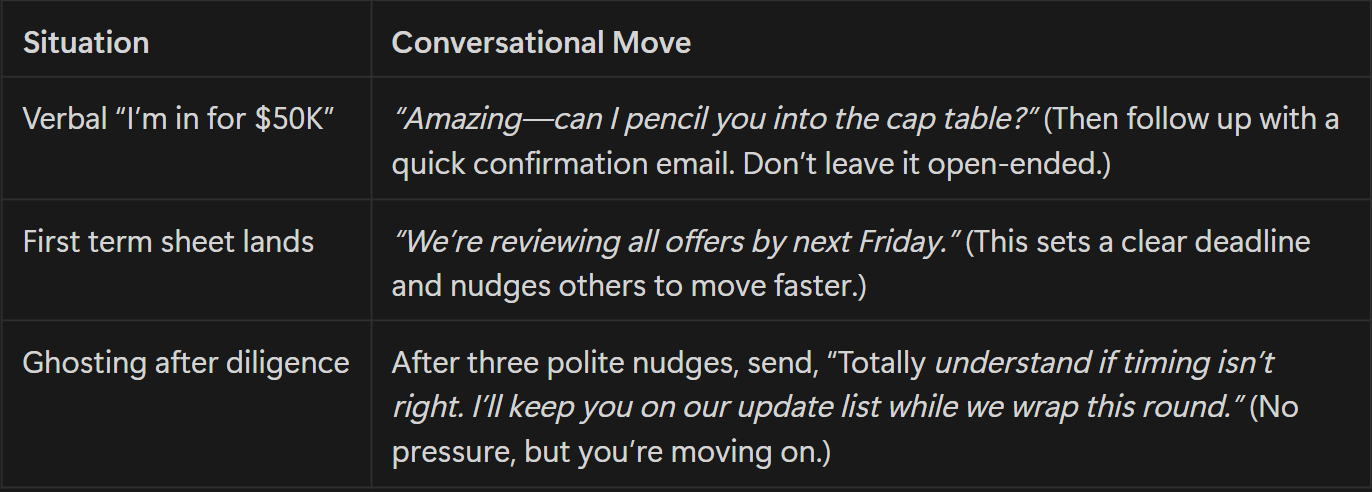

Closing Tactics

At this final stage of your fundraising process, you’re moving from pitched interest to concrete commitments. The table below outlines common scenarios you’ll encounter: locking in a verbal commitment, setting firm deadlines once term sheets arrive, and gracefully handling radio silence after diligence. It also provides example scripts to keep your round moving toward a close.

A quick reminder: a signed term sheet is not money in the bank. Celebrate once the wire lands, not before. Too many founders assume a term sheet equals a closed deal, but it does not.

Having a clear, disciplined fundraising process, backed by warm intros, a strong funnel, and a structured close, is not just nice to have; it is how you stand out in a crowded, fast-moving market.

Conclusion

Raising angel capital or venture backing is neither voodoo nor pure luck; it is pipeline science. Build a fat top-of-funnel, qualify like a hawk, leverage connectors, ship snappy updates, and keep drumming momentum until the wire lands.

Need a cockpit that handles all of the above? Foundersuite combines an investor database, warm-intro engine, CRM, update sender, and data room in one breezy workflow, conceived by CEO Nathan Beckord so founders can spend less time tracking emails and more time shipping product. Turn “how to raise venture capital” into a predictable playbook.