Building and qualifying a list of target investors is a critical first step when raising capital for your startup. Here’s how to use our Investor Database (found in the “Find Investors” section of Foundersuite.com) to speed up the process.

For seed stage startups, we recommend aiming for a list of at least 100–200 potential targets. Fundraising is a “numbers game” and if you’re converting 5–10% of your pitches into commitments you’re doing well.

To hammer home this point, Pandora’s founder famously pitched over 300 VCs before he got a “yes” (the company went on to go public on the NYSE). Similarly, Kathryn Minshew, CEO of TheMuse pitched 148 investors before she finally got one to put down a term sheet.

It’s a numbers game, and we’ve got some “numbers of our own” to help you succeed. We built a database of over 21,000+ venture funds and over 100,000+ angels, family offices, fund-of-funds, PE firms, hedge funds, and more to browse from.

Here are a few common questions and tips for getting the most out of it.

What types of investors are in the Foundersuite database? Are they only in the United States or global?

Of the 121,000 investors in our database, about 2/3rds are angels, with the rest being a mix of Venture Capitalists, Corporate VC, Incubators and Accelerators, Fund of Funds, Investment Banks, Family Offices, Private Equity and Buyout Funds, Investment Consultants and RIAs, Real Estate Investors, Lenders, and even a few Sovereign Wealth Funds.

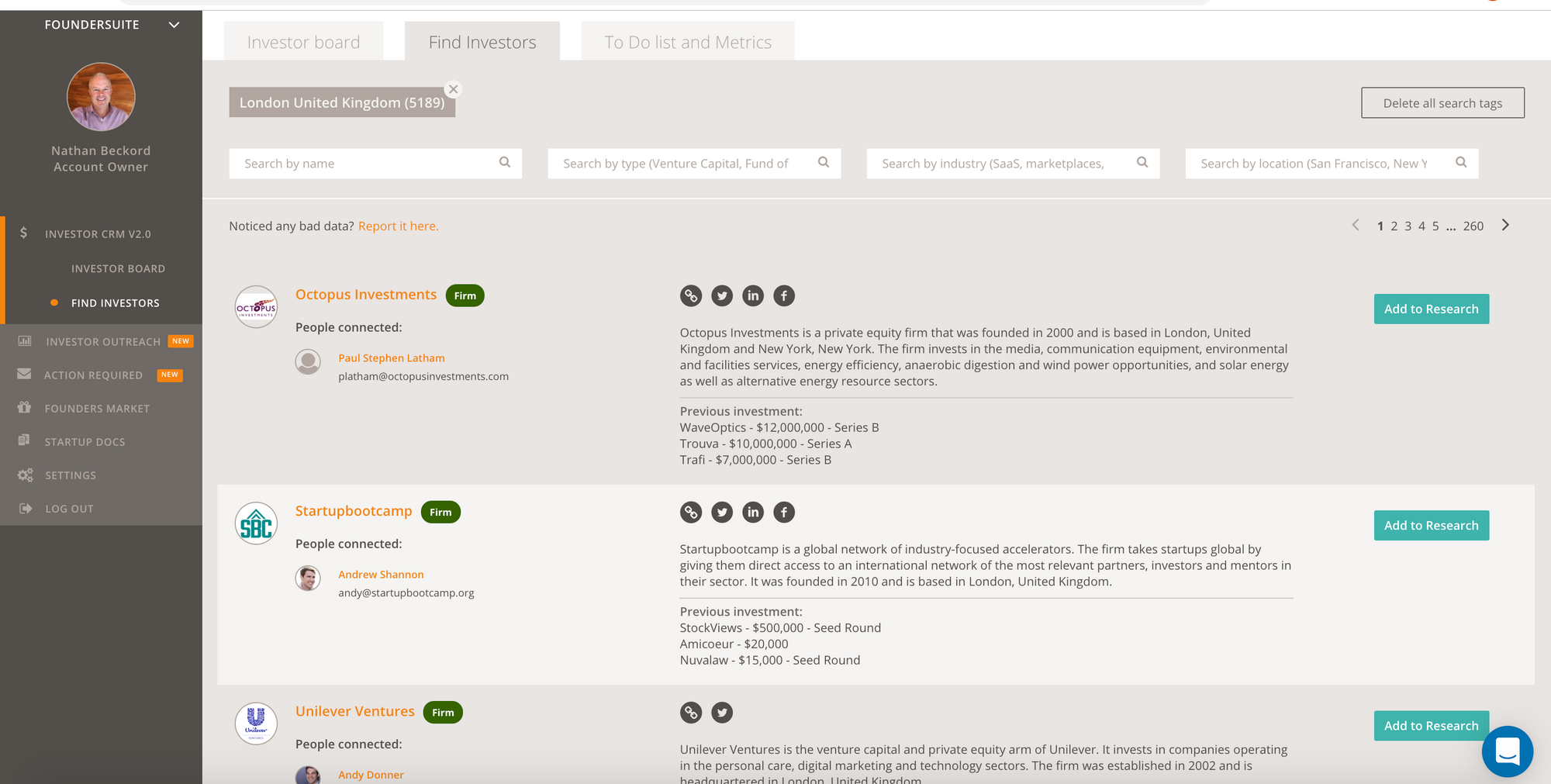

The mix is roughly half based in the US, half global. For example, a search on “New York” returns 12,000 investor results, whereas a search on “London” returns 7,300 results, “Paris” about 2,200, “Sydney” and “Melbourne” combined about 1,100, and “Hong Kong” returns around 800 results.

How do I search this investor database?

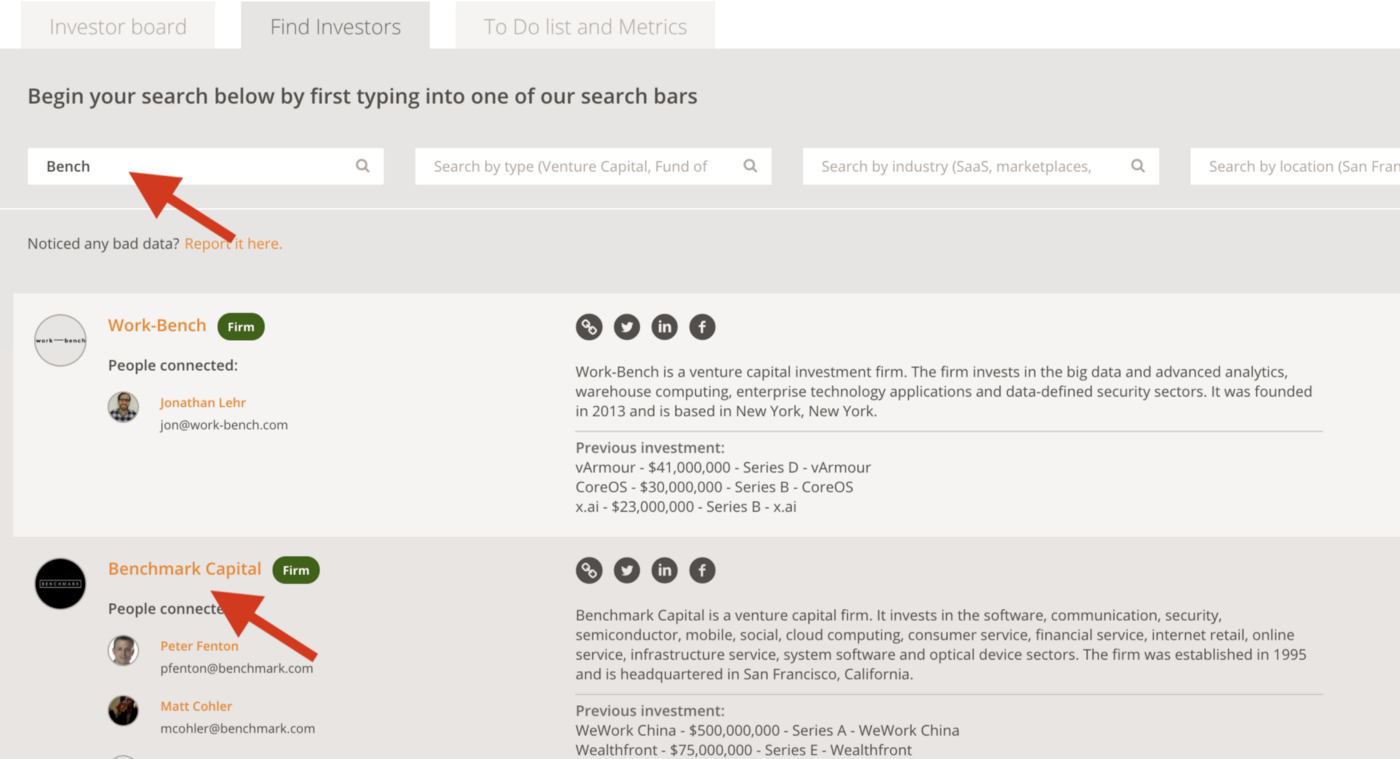

By Name:

If you know who you are looking for, simply type the person or fund name into the first search field and hit enter. You can also enter partial names if you can’t remember the full name. For example, if you enter “Bench” it will return Benchmark Capital as well as others.

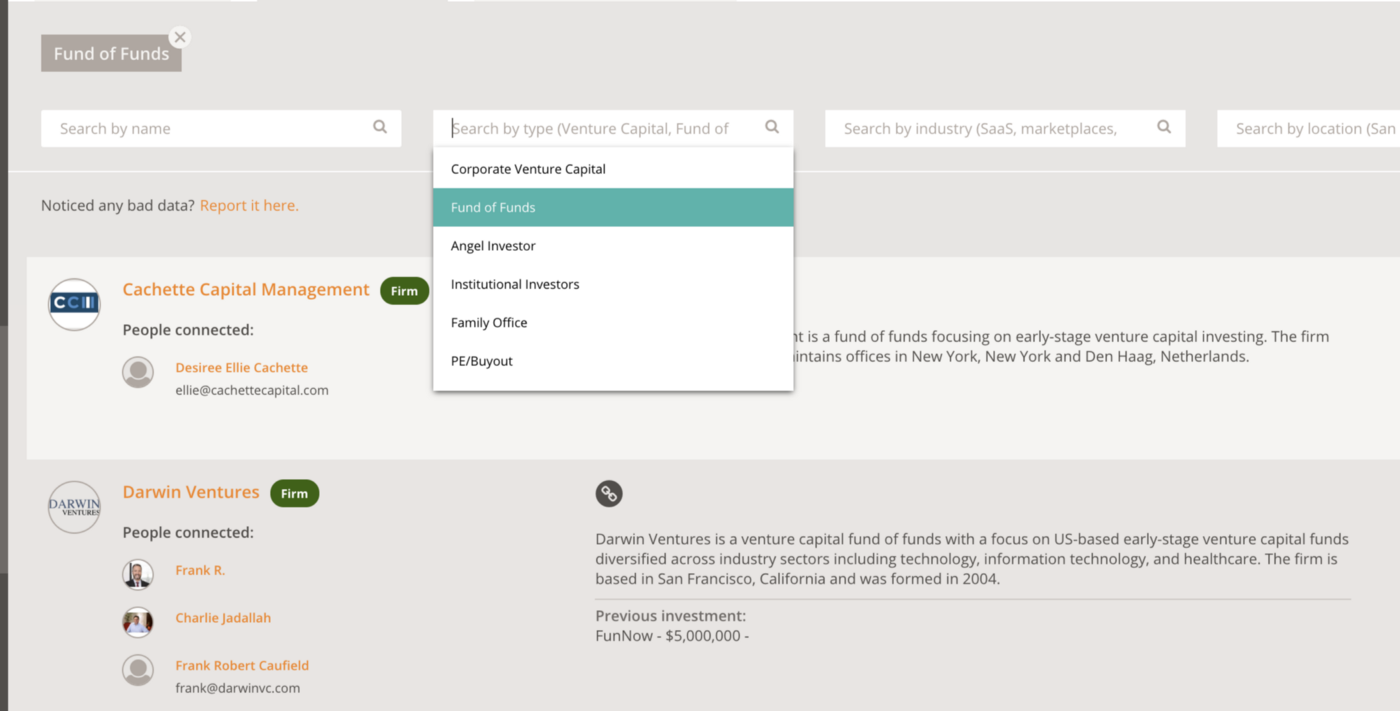

By Type:

In the next column over, you can run a search solely by Type of investor simply by picking the best match from the drop-down menu. The list includes: Venture Capital, Accelerator / Incubator, Fund of Funds, Investment Banks, Corporate Venture Capital, Family Offices, Private Equity and Buyout Funds, Investment Consultants and RIAs, Real Estate Investors, and Lenders.

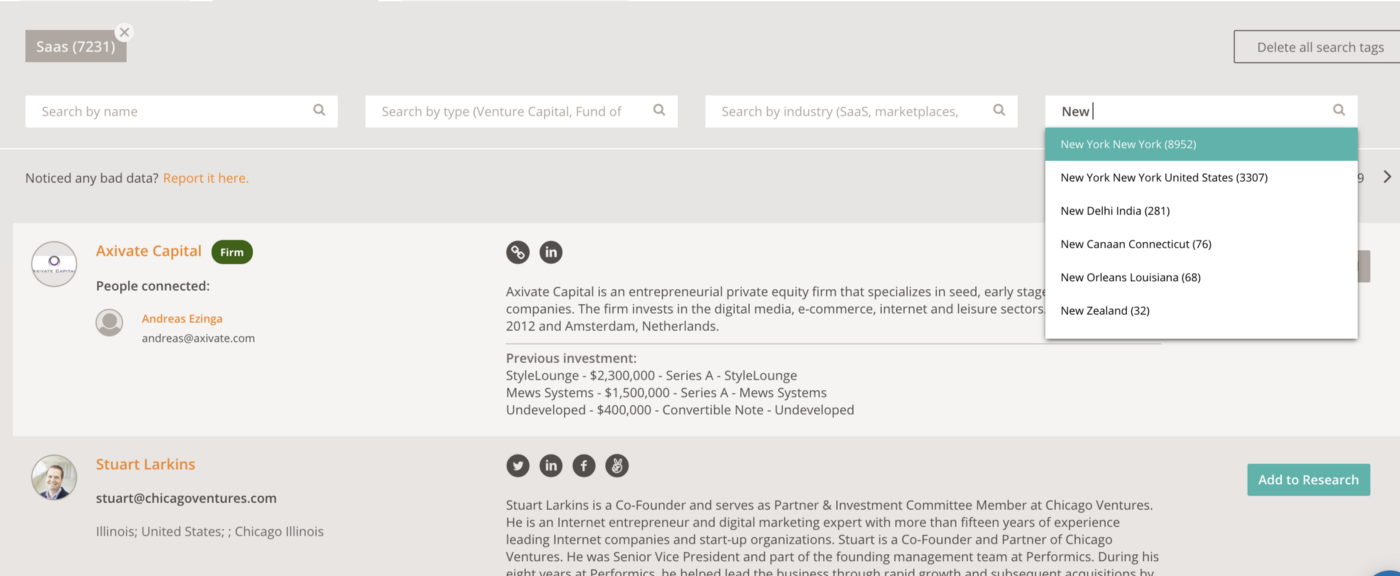

By Market and Location:

To the right of the Type are Market and Location fields. Each investor is tagged with a Market Tag and a Location Tag. Thus, To search the list, you MUST search use one or more of the pre-set tags (i.e. you cannot “free form” search the database).

To find the best Market Tag, start typing the name of your industry — then pause for a moment — then select from the suggested keywords in the drop down menu. For example, if you’re in Fin Tech, start typing “F — I — N” then pick from the resulting choices.

Try combining a few different alternative keywords to get the maximum results (e.g. “artificial intelligence” + “machine learning” or “marijuana” + “cannabis” or “crypto” + “blockchain” + “bitcoin”).

Importantly, when you add multiple Market Tags, it’s an <OR> function and will expand your search. When you add a Location Tag, it’s an <AND> function and will narrow your search results.

Another tip is to search only by your location. Importantly, location search works best using CITY names, for example, use “London” instead of “United Kingdom” and if you add more locations in your region, your results will grow.

As another example, if you’re a startup in Australia, try searching on “Sydney” plus “Melbourne” plus “Perth.”

What happens when I click the “Add To Research” button? Is the investor notified?

No. They are not notified. An investor card is created on your Investor Board in the Research column with that investor’s name and social details, as well as contact information when available. Most of our users will typically spend some time going through the list they created and then “qualify” each lead by looking at their websites or LinkedIn profiles to make sure they do indeed invest in your sector / stage / geography etc.

What investor information is provided in the search results?

Generally, a short bio, a profile picture, and icons which link through to their various online profiles, including LinkedIn, Facebook, Twitter and AngelList pages. When possible, we also link through to their blog or personal web page, or the corporate web site. We also display previous investments to give you a feel for what they actually put money into.

In many cases we display contact information such as email and phone.

The goal of providing this info is: i) to help you learn more about each investor to decide if they are a good fit for you; and ii) so you can “map” your mutual connection paths and find someone to make the warm introduction.

When I add investors to my Investor Board, do they get added to your database?

No, The investors you bring into the system — for example, by uploading a CSV or by adding them one by one — are viewable by you and you only. They are not added to our master database. We do not harvest our users’ investor data in any way.

How did you build this database?

To build the database, we first compiled and assembled several master lists of angels, VCs, and PE firms using our own algorithm. Next, we employed a combination of web crawlers along with several thousand human-hours manually researching the social links and bios for the investors.

Thus, in general the data provided are the investors’ own links; assuming they keep their LinkedIn, Facebook, Website, and AngelList pages current, the data should be accurate and up-to-date.

How much does it cost?

On the Free / Basic plan, it is free to search the investor database up to a limit of the first two pages for each search result. When you find an investor you like and you click “Add To Research” that investor is added to your Investor CRM. You can add up to 25 investors into your CRM on the free plan.

On the Silver and Gold plans, the searches are unlimited. On the Silver plan you can add up to 75 investors to your CRM. On the Gold plan, you can add an unlimited number of investors to your CRM (with a general limit of around 800 per investor board.)

For full pricing details, please see www.foundersuite.com/pricing

How can I trust this info is correct?

We collect and aggregate investor data publicly available on the web, but we do not check each investor’s accreditation or verify the data published by investors on their proprietary pages — that would be beyond the scope of what a small team could do.

We strive to provide accurate info, and if you find something wrong please let us know; however, we cannot guarantee the accuracy of every single field. If you need a higher level of information, you might consider using Pitchbook or CB Insights (keep in mind these services — each of whom employ hundreds of data scientists — run between $15,000 up to $100,000 annually).

Our goal is to provide a simple and easy to navigate investor database to help you build your target list at a reasonable cost.

Will you introduce me to the investors I find?

Sorry, no… that’s not how fundraising works :) To get introduced to investors, you typically should network your way into a “warm intro” from someone who knows you and who knows the investor. Any site that promises to directly match you with investors is probably a scam.

That said, we have made dozens of intros for our customers — ones we have gotten to know personally at our events or online.

If you need some tips on how to get investor intros (even if you don’t have a strong established network check out this video (highly recommended!).

Can I export the data?

Yes. If you are on a Gold subscription (see Foundersuite.com/Pricing) you can export your Investor Board to a CSV file. However, if you use the service in an attempt to scrape and export the database, your account will be terminated.

Our mission is to build a reasonably-priced, quality database that helps Founders raise capital more efficiently. Please keep in mind any large scale scraping or downloading (generally defined as more than what would be in a “typical round” of several hundred investors) violates the terms of service and is strictly prohibited.

Any more questions? Just reach out anytime!