I’m on the phone 15–20 hours a week talking to our startup customers. Most of this time is spent running Foundersuite demos and sharing fundraising tips, but I also listen and learn a ton from these interactions.

One of the patterns I’ve noticed among top startup founders is that they get a “virtuous cycle” going by sending regular investor updates.

In short, this means the value of each update increases the more updates they send.

Here’s how they do it and why it works.

USE CASE #1: Investor Updates to Prospective Investors:

Startups that are fundraising should send a regular progress update to every investor in their funnel. Almost no one does this; but it will set you apart from 99% of the other founders chasing the same (finite) pool of dollars.

In this use case, create a template that focuses on all the “good stuff” happening with your startup. This should include customer or revenue growth, new deals or distribution partnerships, new key hires, and so forth.

I also recommend starting the update with a brief company summary to remind the investors who you are and why you matter, e.g.:

Notably, this “prospective investor” update should be very short — under one page or less — and it should be overwhelmingly positive. This is a sales document, designed to “warm up” the investors you want to raise capital from down the road.

Send this update out once a month or as frequently as you have major news or progress to report. It should go out to all the investors in your funnel — basically, send it to everyone in your funnel who has not told you “no.”

**Bonus funding hack: start building your distribution list months in advance of raising capital. For example, if you’re planning to raise your next round in Q2 of next year, reach out to prospective investors NOW saying, “We are not raising capital at the moment, but will be in a few months. You are right in our sweet spot… may I add you to our newsletter list?”

Many investors will say yes. Here’s a good blog post on this “permission based” way to nurture investor leads in advance of a raise.

Why It Works:

As Mark Suster of Upfront Ventures points out, “investors invest in lines, not dots” meaning they like to build a relationship with founders before cutting a check. It typically takes a meaningful number of interactions with an investor to generate interest and trust.

The other reason this works is because every investor has put money into a startup and then never heard from them again until they were almost out of money. This drives investors crazy. By sending out a regular monthly update, you’re showing that: a) you can execute; and b) you’re a good communicator.

Each incremental update reinforces these factors. This is powerful.

USE CASE #2: Investor Updates to Current Investors:

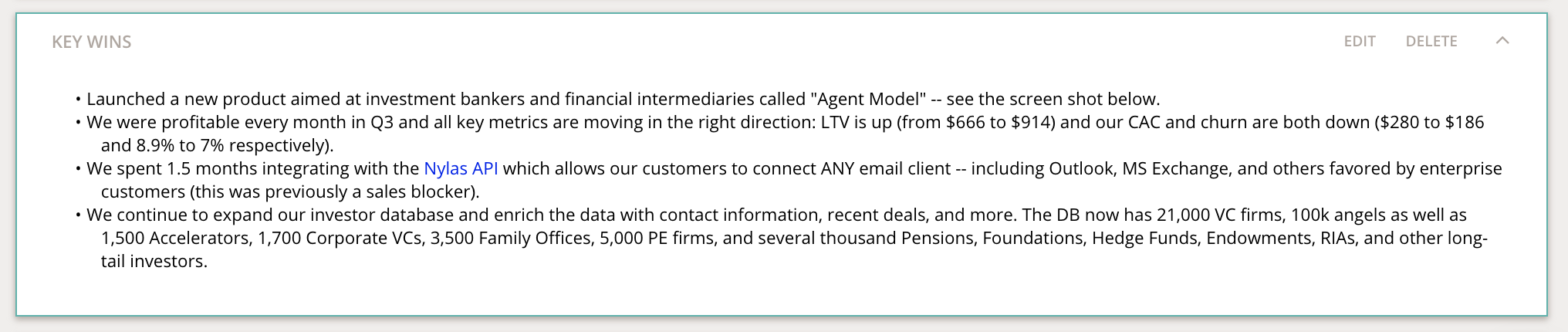

As soon as you have a set of investors on your cap table, I recommend switching up the pace of your updates to a bi-monthly or quarterly cadence. I also recommend changing up the format. You don’t need the Company Summary at the top any more, since these investors know you; instead, I suggest starting off strong with “Quarterly Highlights and Wins” as per above.

The other major difference between this update template and the one for prospective investors is that it includes all the warts, pimples, and challenges your startup is going through. This update is meant to keep your investors in the loop, but even more importantly, it’s designed to get them helping out. The best founders do a really good job of viewing their investor base as a resource, and getting the most out of this resource.

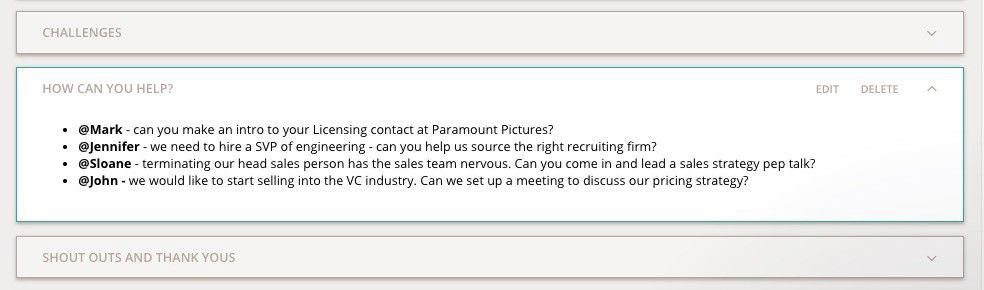

Thus, add 3 additional sections to this template: i) Challenges; ii) How You Can Help; and, iii) Shout Outs and Thanks. A table of your most important KPIs is also very helpful; now that you have investors, you’ll want to get into a habit of regular metrics reporting. This will pay off handsomely when you go to raise your next round.

Why It Works:

The “virtuous cycle” effect comes into play here when you send an update with a “how you can help” ask followed 2 months later with a Shout Outs and Thanks specifically praising those who have been helpful.

Be specific when asking for help — both who you want to take action, and what specific action you want them to take.

For example:

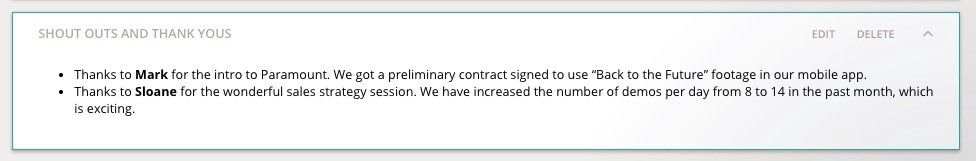

Then, in your next update, specifically call out who helped you and what the results were.

….and so on. This Ask → Thanks cycle greatly increases engagement and leverages your advisors and investors to their fullest. The visibility rewards those who are helping and can “prod” your passive, quiet investors to step up their game.

Summary / TL;DR

Create two investor update templates: one to “warm up” prospective investors, and one to activate your investors once you close your round.

The prospective investor update should focus on progress, traction, and all the “good things” going on with your startup. Send it out monthly to build relationships in advance of asking for money.

The existing investor update should focus on highlights and challenges, and it should contain an ask for help and thanks. Send it quarterly to engage and leverage your stakeholders.

Do these two things, and you’ll enjoy the “investor update virtuous cycle” in no time.