As a founder, staying ahead means knowing who’s actively writing checks—and what they’re looking to fund. Over the last couple of months, dozens of new venture funds have launched across the globe, ready to back early-stage startups in sectors like climate, AI, consumer tech, Web3, and more.

And here’s the thing: newer funds—especially debut or second-time funds—tend to be more accessible to first-time founders. They’re still building their reputation, still proving their strategy, and usually far more open to meeting new founders outside the usual networks.

Plus, fresh funds are often the most active. Unlike older funds that might be focused on follow-ons, new vehicles are out hunting for their next 10–15 core investments.

So whether you're raising your first round or lining up your next one, knowing who’s recently raised (and what they’re hunting for) can save you weeks of outreach and guesswork.

That’s why we put together this list of 30 VC funds launched in Q1 2025—each with clear focus areas, fund size, and decision-makers listed.

If you're fundraising now (or planning to), this is the list to bookmark.

Let’s dive in.

1. Ascent Energy Ventures - Fund I

Website: ascentev.com

LinkedIn: linkedin.com/company/ascent-energy-ventures

Team Page: ascentev.com/#team-section

HQ Location: Denver, Colorado, USA

Stage Focus: Seed to Series A

Category Focus: Energy Technology, CleanTech, Sustainability

Fund Size: $50M

What Caught Our Eye: Backing the digital backbone of the energy transition—think AI for grids and geospatial tools for climate risk.

2. Homegrown Capital - Fund I

Website: homegrown.capital

LinkedIn: linkedin.com/company/homegrown-capital

Team Page: homegrown.capital/team

HQ Location: Brookings, SD, USA

Stage Focus: Seed to Series A

Category Focus: Consumer Products, Food & Beverage, AgTech

Fund Size: $30M

What Caught Our Eye: Investing in the overlooked heartland—backing tech-driven startups across the Northern Plains.

3. LoftyInc Capital - Fund I

Website: loftyinc.vc

LinkedIn: linkedin.com/company/loftyincvc

Team Page: loftyinc.vc/team

HQ Location: Victoria Island, Lagos, Nigeria

Stage Focus: Seed to Series A

Category Focus: Technology, Fintech, Healthtech, Agtech

Fund Size: $43M

What Caught Our Eye: Flutterwave—one of LoftyInc's standout portfolio companies—has quickly become Africa's leading payments technology platform.

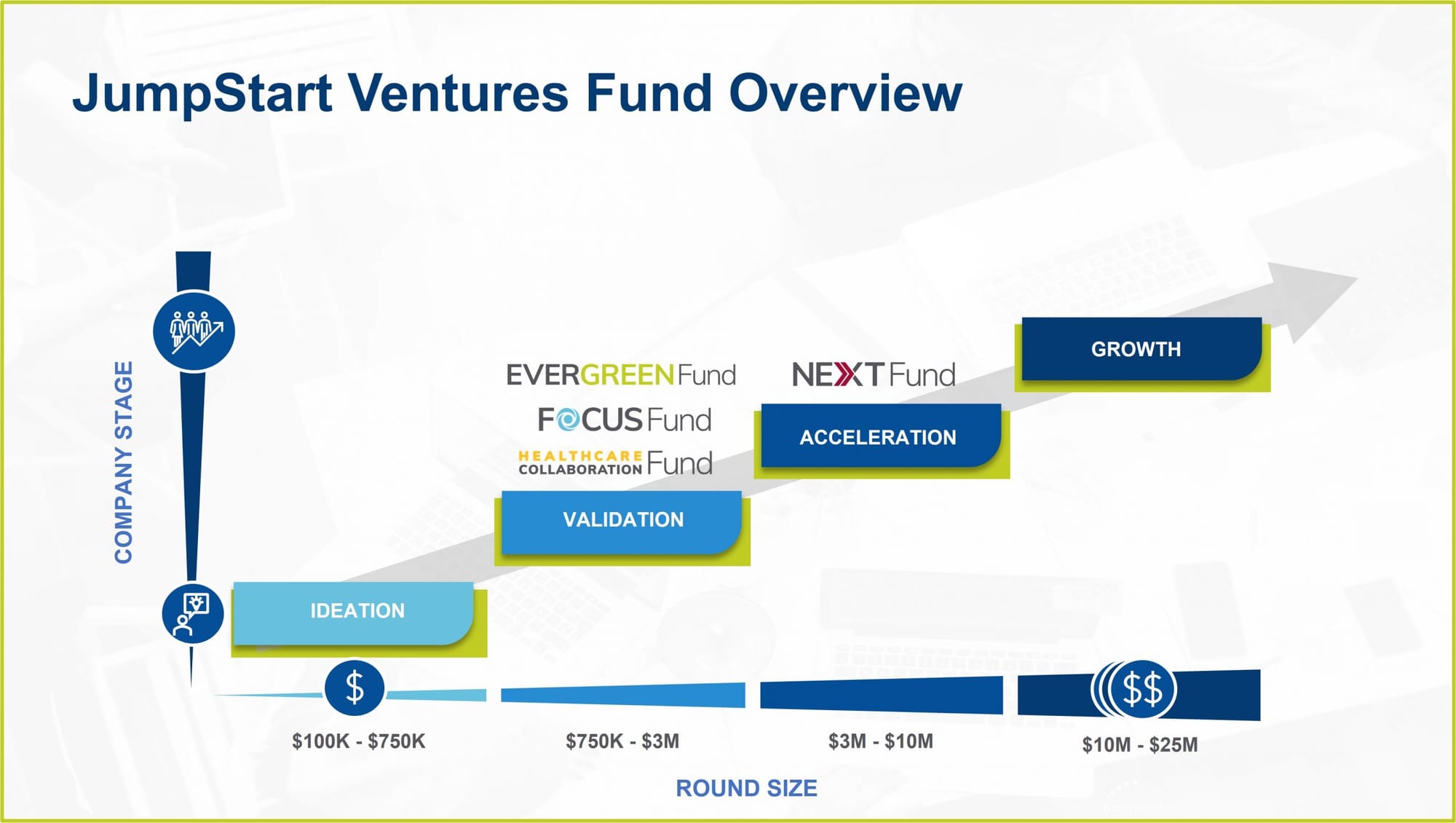

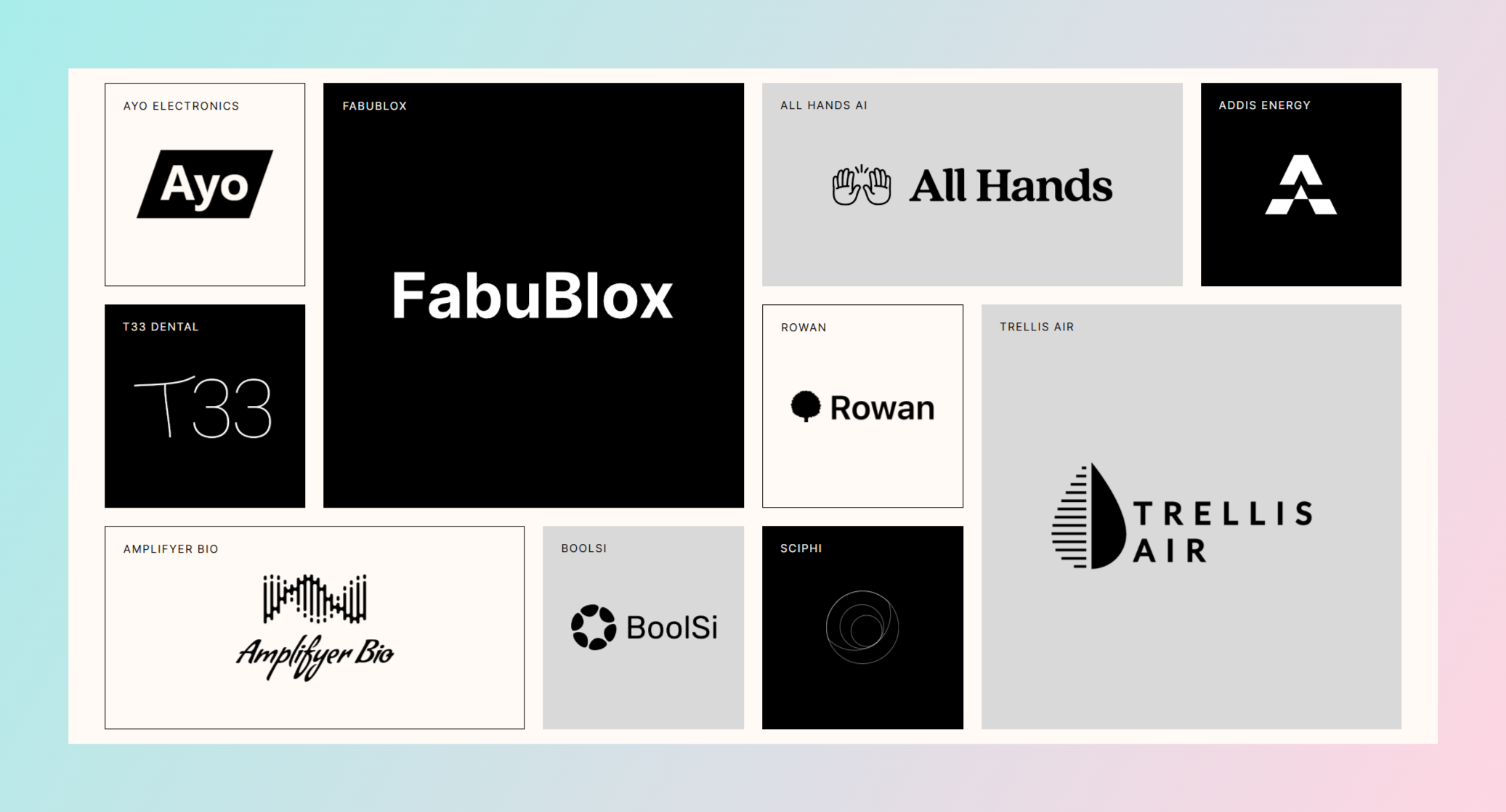

4. Jumpstart Ventures - Fund II

Website: jumpstart.vc

LinkedIn: linkedin.com/company/jumpstart-vc

Team Page: jumpstart.vc/team

HQ Location: Cleveland, Ohio, USA

Stage Focus: Seed to Series A

Category Focus: Healthcare, Software, Advanced Manufacturing

Fund Size: $25M

What Caught Our Eye: This firm is powering Ohio's tech ecosystem, with over $140M in assets and 100+ active startups. Their hands-on approach offers capital, mentorship, and a strong co-investment network.

5. Jsquare - Fund I

Website: jsquare.co

LinkedIn: linkedin.com/company/jsquare-co

Team Page: jsquare.co/about

HQ Location: Singapore

Stage Focus: Seed to Series B

Category Focus: Blockchain, Web3, Fintech

Fund Size: $50M

What Caught Our Eye: They're backing innovative Web3 projects like MinionLabs, which turns everyday devices into decentralized data miners.

6. Disrupt.com - Fund I

Website: disrupt.com

LinkedIn: linkedin.com/company/disruptofficial

Team Page: disrupt.com/about

HQ Location: Dubai

Stage Focus: Seed to Series A

Category Focus: AI, Cybersecurity, Web3.0, Automotive Technology, and Retail Innovation

Fund Size: $100M

What Caught Our Eye: They're crafting AI-first ventures from the ground up, co-building with founders, and scaling globally. Their portfolio includes Cloudways, acquired by DigitalOcean for $350M.

7. Aligned Climate Capital - Fund I

Website: alignedclimatecapital.com

LinkedIn: linkedin.com/company/aligned-climate-capital

Team Page: alignedclimatecapital.com/our-team

HQ Location: New York, USA

Stage Focus: Growth

Category Focus: Clean Energy, Sustainable Infrastructure, Climate Tech

Fund Size: $85M

What Caught Our Eye: Donates 3% of profits to climate nonprofits—impact is literally baked into the model.

8. Soul Street Ventures - Fund I

Website: soulvp.com

LinkedIn: linkedin.com/company/soulvp

Team Page: linkedin.com/in/prasanthchilukuri (Prasanth Chilukuri, Founder & Managing Partner)

HQ Location: Houston, Texas, USA

Stage Focus: Seed to Series A

Category Focus: Consumer, Lifestyle, Wellness

Fund Size: $22.5M

What Caught Our Eye: Backs “soulful” startups—mission-driven founders who scale with values, not just velocity.

9. Daybreak Ventures - Fund I

Website: daybreakventures.com

LinkedIn: linkedin.com/in/rexwoodbury (Rex Woodbury, Partner)

HQ Location: New York, USA

Stage Focus: Early-stage

Category Focus: Internet, Software, and Technology-Enabled Businesses

Fund Size: $33M

What Caught Our Eye: Founder-first firm, backing mission-driven startups with hands-on support and conviction.

10. Pillar VC - Fund IV

Website: pillar.vc

LinkedIn: linkedin.com/company/pillar-vc

Team Page: pillar.vc/team

HQ Location: Boston, Massachusetts, USA

Stage Focus: Seed to Series A

Category Focus: Deep Tech, Life Sciences, AI

Fund Size: $175M

What Caught Our Eye: Pillar VC backed Algorand at seed—now a leading blockchain platform. They often co-found companies with scientists and engineers before they even leave the lab.

11. Susa Ventures - Fund V

Website: susaventures.com

LinkedIn: linkedin.com/company/susa-ventures

Team Page: susaventures.com/#home-investors

HQ Location: San Francisco, California, USA

Stage Focus: Seed

Category Focus: Enterprise Applications, High Tech, FinTech

Fund Size: $175M

What Caught Our Eye: Early backers of Robinhood and Flexport, Susa Ventures has a knack for spotting unicorns at seed stage.

12. Ribbit Capital - Fund VI

Website: ribbitcap.com

LinkedIn: linkedin.com/company/ribbit-capital

Team Page: ribbitcap.com/team

HQ Location: Palo Alto, California, USA

Stage Focus: Seed to Growth

Category Focus: FinTech

Fund Size: $500M

What Caught Our Eye: Ribbit Capital’s early bet on CoinSwitch Kuber helped it grow into India’s leading crypto platform with over 10 million users.

13. Prime Venture Partners - Fund V

Website: primevp.in

LinkedIn: linkedin.com/company/primevp

Team Page: primevp.in/team

HQ Location: Bangalore, India

Stage Focus: Seed to Series A

Category Focus: FinTech, SaaS, HealthTech

Fund Size: $100M

What Caught Our Eye: Their portfolio includes Quizizz, MyGate, NiYO, and Dozee, with recent exits like Happay (acquired by Cred for $180M) and Perpule (acquired by Amazon).

14. Cendana Capital

Website: cendanacapital.com

LinkedIn: linkedin.com/company/cendana-capital

Team Page: cendanacapital.com/our-team

HQ Location: San Francisco, California, USA

Stage Focus: Seed & Early Stage Venture

Category Focus: Invests in seed venture capital funds across various sectors

Fund Size: $400M

What Caught Our Eye: Cendana Capital's $2B+ AUM backs over 4,800 startups, including 130+ unicorns. They lead seed VC fund investments globally, offering $10–20M commitments to top-tier emerging managers.

15. Adara Ventures - IV

Website: adara.vc

LinkedIn: linkedin.com/company/adaravc

Team Page: adara.vc/team

HQ Location: Madrid, Spain

Stage Focus: Early-stage (Seed to Series A)

Category Focus: Deep Tech, Enterprise Software, Cybersecurity, AI

Fund Size: $106M

What Caught Our Eye: Their portfolio company PlayGiga became the first Spanish startup acquired by Meta.

16. Equator - Fund I

Website: equator.vc

LinkedIn: linkedin.com/company/equator-africa

Team Page: equator.vc/equator-vc-team

HQ Location: Nairobi, Kenya

Stage Focus: Early-stage

Category Focus: Climate Tech, Renewable Energy, Sustainable Infrastructure

Fund Size: $55M

What Caught Our Eye: They focus on early-stage climate tech in Sub-Saharan Africa. They back startups in energy, agriculture, and mobility, with investments ranging from $750K to $2M.

17. Fusion Fund - Fund IV

Website: fusionfund.com

LinkedIn: linkedin.com/company/fusion-fund

Team Page: fusionfund.com/team

HQ Location: Palo Alto, California, USA

Stage Focus: Seed to Series A

Category Focus: Deep Tech, AI, Healthcare, Enterprise Software

Fund Size: $190M

What Caught Our Eye: They back technical founders in AI, healthcare, and industrial automation, with a portfolio featuring GrubMarket, Otter.ai, and Element Biosciences.

18. Daphni - Fund III

Website: daphni.com

LinkedIn: linkedin.com/company/daphni

Team Page: daphni.com/team

HQ Location: Paris, France

Stage Focus: Seed to Series B

Category Focus: Consumer Tech, Platform Businesses, Digital Transformation

Fund Size: $215M

What Caught Our Eye: Daphni is flipping the script on French venture capital—backing founders from rural and underserved areas with checks up to €1M. Their mission is to uncover untapped talent beyond Paris and elite schools.

19. Long Journey Ventures - Fund IV

Website: longjourney.vc

LinkedIn: linkedin.com/company/longjourney

Team Page: longjourney.vc/team

HQ Location: San Francisco, California, USA

Stage Focus: Pre-Seed to Seed

Category Focus: Consumer, Health, Frontier Tech

Fund Size: $181.8M

What Caught Our Eye: They back the “magically weird” — founders with unconventional ideas and bold missions. Their portfolio includes Mindbloom, TruMed, and Crusoe Energy, with early investments in SpaceX, Uber, Notion, and Affirm.

20. Innosphere Wyoming Innovation Fund – Fund I

Website: innospherefund.com

LinkedIn: linkedin.com/company/innosphere-ventures

Team Page: innospherefund.com/leaders

HQ Location: Fort Collins, Colorado, USA

Stage Focus: Seed to Early Stage

Category Focus: Biosciences, Cleantech, Software, Hardware

Fund Size: $11M

What Caught Our Eye: Their portfolio includes GelSana, a company developing hydrogels to accelerate wound healing for diabetic ulcers and other wounds. (Very Interesting)

21. Sempervirens - Fund III

Website: sempervirensvc.com

LinkedIn: linkedin.com/company/sempervirensvc

Team Page: sempervirensvc.com/team

HQ Location: San Mateo, California, USA

Stage Focus: Seed to Series B

Category Focus: Future of Work, Health & Wellness, Fintech

Fund Size: $177M

What Caught Our Eye: The firm leverages its proprietary SemperSystem™ to provide portfolio companies with go-to-market deals, expert operating support, and deep market insights, accelerating growth and scaling efforts.

22. 2150 - Fund I

Website: 2150.vc

LinkedIn: linkedin.com/company/2150vc

Team Page: 2150.vc/team

HQ Location: London, United Kingdom

Stage Focus: Early-stage

Category Focus: Urban sustainability, climate tech, built environment

Fund Size: $200M

What Caught Our Eye: Their portfolio companies have collectively mitigated nearly one megaton of CO₂ emissions annually. The firm tracks impact metrics like air pollution reduction and water savings alongside financial performance.

23. Elbow Beach - Fund II

Website: elbowbeach.com

LinkedIn: linkedin.com/company/elbow-beach

Team Page: elbowbeach.com/team

HQ Location: London, United Kingdom

Stage Focus: Seed to Series A

Category Focus: Decarbonisation, sustainable energy, social impact businesses

Fund Size: $80M

What Caught Our Eye: They are taking a unique approach by focusing on climate tech with clear economic benefits. They’ve backed Anaphite, a battery tech startup, and Barton Blakeley, which converts CO₂ emissions into clean energy.

24. Haun Ventures - Fund I

Website: haun.co

LinkedIn: linkedin.com/company/haun-ventures

Team Page: haun.co/team

HQ Location: San Francisco, California, USA

Stage Focus: Early-stage to growth

Category Focus: Web3, blockchain infrastructure, decentralized finance, crypto, on-chain gaming

Fund Size: $1B

What Caught Our Eye: Haun Ventures was founded by former federal prosecutor Katie Haun, and is a leading venture capital firm in the Web3 and crypto space.

25. Maven 11 - Fund III

Website: maven11.com

LinkedIn: linkedin.com/company/maven11

Team Page: maven11.com/team

HQ Location: Amsterdam, Netherlands

Stage Focus: Early-stage

Category Focus: Crypto-native projects, decentralized finance, blockchain infrastructure

Fund Size: $107M

What Caught Our Eye: Their portfolio includes over 70 companies, with recent investments in August (formerly Fractal Protocol), Accrue, and GTE.

26. Red Bull Ventures - Newly launched corporate fund

Website: redbull.ventures

LinkedIn: linkedin.com/company/redbullventures

HQ Location: Fuschl am See, Austria

Stage Focus: Early-stage

Category Focus: Media & Entertainment Technology, Advanced Manufacturing & Supply Chain Solutions, Sports & Human Performance, Digital & Technological Innovation, Consumer Engagement & Retail Innovations, Sustainability

Fund Size: $212M

Key People: Nai-Tseng Chen (Global Head), Sabrina Jones (Head of Investments)

What Caught Our Eye: They back visionary entrepreneurs who challenge the status quo across sectors like media, advanced manufacturing, sports, digital innovation, consumer engagement, and sustainability.

27. Revent - Fund II

Website: revent.vc

LinkedIn: linkedin.com/company/revent-vc

HQ Location: Berlin, Germany

Stage Focus: Early-stage

Category Focus: Climate Tech, Healthcare, Industrial Decarbonization, Reskilling, Empowerment

Fund Size: $106M

Key People: Otto Birnbaum (Founding Partner), Lauren Lentz (Founding Partner)

What Caught Our Eye: Revent focuses on backing purpose-driven founders tackling systemic challenges in sectors like climate and healthcare.

28. NuVentures - Fund I

Website: nuventures.vc

LinkedIn: linkedin.com/company/nuventures

HQ Location: New York & Bangalore

Stage Focus: Early-stage (Startups with a strong India connection)

Category Focus: AI, SaaS, Consumer Tech

Fund Size: $75M

Key People: Venk Krishnan (Founder & CEO), Visveswaran Kartik (Partner)

What Caught Our Eye: NuVentures focuses on early-stage startups with strong ties to India, investing in AI, SaaS, and consumer tech. They offer personalized mentorship and global scaling support.

29. Outlier Grove - Fund II

Website: outliergrove.com

LinkedIn: linkedin.com/company/outlier-grove

HQ Location: London, United Kingdom

Stage Focus: Angel and Seed Focus

Category Focus: B2B Technology Startups

Fund Size: $20M

Key People: Candice du Fretay (Founder and Solo GP)

What Caught Our Eye: Outlier Grove is a European angel and seed fund investing $200K–$500K in exceptional B2B tech founders.

30. Revaia Growth - Fund II

Website: revaia.com

LinkedIn: linkedin.com/company/revaia

HQ Location: Paris, France (Offices also in Berlin, London, and presence in North America)

Stage Focus: Growth-Stage Focus (Series B to IPO or Buyout)

Category Focus: Energy Transition, AI for Insurance, Cybersecurity, Sustainable Innovation

Fund Size: $266M

Key People: Alice Albizzati (Founding Partner), Elina Berrebi (Founding Partner)

What Caught Our Eye: Backed Aircall and GoHenry. Europe’s largest female-founded growth fund, with a sharp focus on sustainability.

Here’s a cold email template inspired by Tetra Insigts cofounder Michael Bamberger that you can use to reach out to these 30 funds:

Subject line: RE: Pre-seed round? B2B, SaaS, qualitative data analysis

Hi ___,

First and foremost, I hope you and your family are safe, healthy and as comfortable as possible during these crazy times.

I'm the co-founder of Tetra Insights, a B2B SaaS startup based in Boulder. I'm reaching out to see if you're available for a 30-minute call to learn about our company.

We are raising a round of financing and I want to introduce myself to see if we might be a good mutual fit. Our transfer software transforms audio and video into business intelligence.

We launched in January and generated X number of revenue while in beta RMRS. Currently why from companies including LexisNexis, Yara and Segment where our technology powers their customer insights practices.

We have a great team. Our customers love our products. We validate our enterprise use cases. We're raising this round to accelerate our product development and go to market efforts.

Below are links to our one-pager and deck.

If you'd like some background info, please let me know if Tetra sounds like a good fit.

{{Name}}

It works. One of Tetra’s lead investors came from that very first batch of cold emails.

So don’t just skim this list—study it. Some of these are brand-new firms making their first bets. Others are on Fund II, III, or even IV, with fresh capital and new theses. Either way, these funds are actively deploying right now.

Look closely at their stage, sector, and check size. If a few feel like the right match for what you’re building, reach out—but do it thoughtfully. No blasts. No generic pitch decks. Just a clear, tailored note that shows you’ve done the work.

Because when it comes to early-stage fundraising, investor fit > warm intros. Every time.

Good luck out there :)